Bioplastics are not just innovative products. Their development requires establishing relationships between major contractors and polymer chemists. Alliances are needed in the industrial sector to allow for new raw materials, increasing the crossover between chemistry and biochemistry. Total is turning its attention to these changes in the industry.

Patrick Pinenq and Dimitri Rousseaux work in bioplastic development at Total. They are at the interface between R&D and the market, where major decision-makers and specialised experts are reshaping the industrial sector.

We are seeing new bioplastics made from coconuts and shrimp shells. How do these look from an industrial perspective?

Patrick Pinenq. They are interesting from a scientific and technological standpoint. But from an industrial perspective they are niche products because the raw materials simply aren’t available in sufficient quantities. In industry, scale is key. Over 360,000 kT of plastic is produced globally per year, requiring plentiful, cheap raw materials. That’s why petroleum is so useful.

Dimitri Rousseaux. If you want to work with bio-sourced and biodegradable materials, you need sufficient quantities to make an impact. Otherwise, production levels will remain negligible. That being said, to produce bioplastics requires biotechnological processes, therefore rethinking production scales. Manufacturing in clusters may be more useful than giant factories, for example.

But we still need to get these new polymers into the real economy. That’s why we’re mainly looking at raw materials that are available in sufficient quantities, such as vegetable oils, sugar and starch. We want to ensure industrial scale production; around several hundred thousand metric tons. That’s why Total is developing our second PLA factory at Grandpuits in Seine-et-Marne, in France. When its 100kT capacity is added to that of the Total factory in Thailand (75kT), Total Corbion PLA will be the world’s number one PLA manufacturer.

Are production costs significantly higher than those of petroleum?

Patrick Pinenq. Yes, the raw materials are more expensive. But there are a couple of things to take into account. First, in a final product (container and content), like a pot of yogurt for example, plastic raw materials represent only a small percentage of the overall cost. Hence, the higher cost is not just the inputs. New technologies, skills and investment also make bioplastics more expensive. So, these kinds of projects have to be developed with a close eye on the needs of end clients who will bear the extra cost.

Development of new polymers must reduce the environmental impact of plastics, which requires cooperation of everyone along the value chain. When consumers are closely involved in a product’s end-of-life, they are also more interested in the effects and origin of the plastics we develop for them.

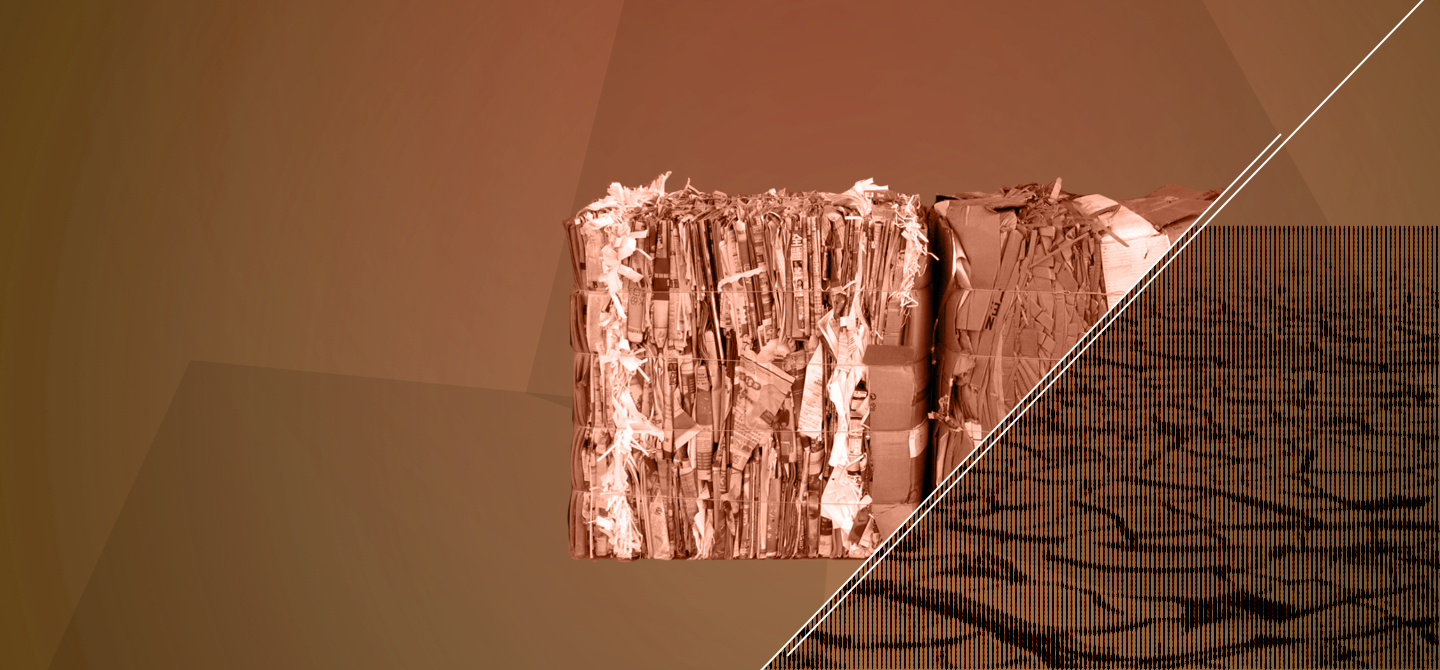

In 2019, Total got together with Mars and Nestlé to develop chemical recycling in France. In October 2020, Total announced the construction of France’s first chemical recycling plant, in partnership with Plastic Energy. The plant is set to start operations in 2023, with a processing capacity of 15kT of plastic waste per year. Total, L’Oréal and Lanzatech have also just announced a world first: a plastic cosmetic bottle made from industrial carbon emissions (in this case, gas emissions from steel factories). This shows that all companies in the value chain are now concerned with its overall impact.

Is the work of polymer chemists changing significantly?

Dimitri Rousseaux. Firstly, we have to consider a wider range of effects when developing our products, taking into account their durability for instance, which is part of their carbon footprint. So, all solutions must undergo a lifecycle analysis in order to make sure they are environmentally friendly and avoid well-intentioned mistakes. We have teams of specialists for life cycle analysis.

Secondly, our industry is forging alliances throughout the value chain in order to generate synergies. We are expanding our areas of expertise in R&D beyond our traditional remit, since we now have some skills in biotech, where we are running laboratories and strategic collaborations. R&D is driving the current transformation.