Strengths and limits of the Central Bank’s digital euro

- In October 2025, the European Central Bank could take a major step forward with the introduction of the digital euro, its central bank digital currency (CBDC).

- The introduction of a CBDC raises questions about its potential impact on financial stability, particularly the risk of disintermediation, although there are some nuances to consider.

- CBDCs could improve the transparency and traceability of transactions – if they take privacy issues into account.

- The ECB, in collaboration with European institutions, is developing a strict regulatory framework for the digital euro (data protection standards, etc.).

- The digital euro for the general public is part of a strategy to reduce Europe’s dependence on foreign payment infrastructures (Visa, Mastercard).

In October 2025, the European Central Bank could take a decisive step forward with the introduction of the digital euro, the central bank digital currency (CBDC). This project, which is intended to complement existing cash and electronic payments, has recently made significant progress. In December 2024, the ECB published its second progress report1, detailing the progress made in the preparatory phase of the digital euro. The report highlights key aspects such as privacy protection, holding limits and offline payments. At the same time, a study published in March 2025 reveals that 58% of European citizens think that they are “unlikely or very unlikely” to use the digital euro for their everyday payments2.

How will this innovation fit into Europe’s financial architecture? What impact will it have on the traditional banking model, which relies heavily on deposit-taking? Can it really offer a credible alternative to private initiatives and digital currencies from other economic powers?

Underlying these questions is the need to redefine the balance between financial stability and innovation, regulatory control and public acceptance. Beyond the technical challenges, the digital euro is part of a broader transformation of monetary and banking mechanisms, in which the dynamics of trust, access and intermediation are being fundamentally rethought.

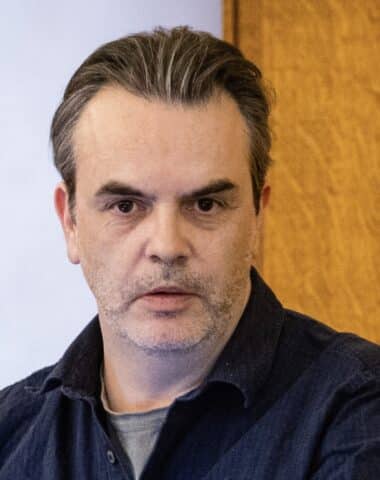

These issues require a nuanced approach, combining analysis of market structures with an understanding of monetary and regulatory policies. It is precisely in this area that the insights provided by Julien Prat, an economist specialising in decentralised markets, and Jézabel Couppey-Soubeyran, an expert in monetary policy and banking regulation, converge.

Is financial stability a double-edged sword?

The introduction of a CBDC raises questions about its impact on financial stability, particularly through the risk of disintermediation. If a significant proportion of deposits is transferred to the CBDC, banks’ lending capacity could decline, affecting the financing of the real economy. A report by the Banque de France indicates that, in an extreme scenario, the substitution of deposits would reduce bank financing resources by 10% to 15%3.

“The main risk is that individuals will prefer to deposit their money directly with the ECB rather than with commercial banks. If too large a share of bank deposits shifts to the ECB, this could weaken the economic model of banks, which use these deposits to finance their loans,” explains Julien Prat. He also points out that “in the event of a bank run, people could want to transfer their money en masse from commercial banks to the ECB, which would increase the instability of the system.”

To limit this risk, the monetary institution plans to introduce a cap on digital euro accounts, “which would prevent a total shift of funds and limit the impact on financial stability,” adds the researcher.

However, this precaution is not without controversy. Jézabel Couppey-Soubeyran points to the influence of the banking sector in these decisions: “The idea that the digital euro could undermine financial stability is primarily put forward by commercial banks, which are reluctant to adopt it, particularly for the general public.” She regrets that this cap prevents the digital euro from offering direct access to central bank money, which “could restore a genuine public service for money.”

Furthermore, CBDCs could improve the transparency and traceability of transactions. Thanks to the integration of technologies such as blockchain, financial flows would be recorded in a decentralised and secure manner, making it easier for regulatory authorities to detect fraud and monitor systemic risks. This improved traceability could strengthen confidence in the financial system, provided that privacy issues are also taken into account4.

However, this is a major point of concern, as Julien Prat points out: “The main issue is transaction confidentiality. With a digital euro, payments could be tracked directly by the ECB, raising concerns about financial surveillance.” This point is tempered by Jézabel Couppey-Soubeyran, who believes that “transaction traceability already exists today, since most payments are made by bank transfer or bank card. The loss of confidentiality associated with the digital euro would therefore be marginal.”

In terms of monetary policy, CBDCs offer new levers for intervention. For example, they could enable direct cash transfers to households in times of crisis, thereby improving the transmission of ECB policies. “The digital euro would open up the possibility of implementing “helicopter money” operations, which involve transferring central bank money directly to households or businesses in the event of a crisis, particularly during periods of deflationary pressure,” explains Jézabel Couppey-Soubeyran. However, she believes that “one limitation of this mechanism is the lack of control over the use of the funds. Some of the money distributed could finance expenditure that is contrary to the green transition. However, helicopter money could be envisaged to finance certain investments necessary for the transition, in particular those whose lack of profitability justifies subsidy financing. This opens up new horizons.”

Furthermore, by complementing traditional instruments, CBDCs could facilitate the implementation of measures such as effective negative interest rates, although this would require an adaptation of existing regulatory frameworks5. In addition, Jézabel Couppey-Soubeyran expresses reservations about “this argument for taxing deposits, which is very difficult to defend.”

Framing the transition to the digital euro

The Central Bank, in collaboration with European institutions, is developing a strict regulatory framework for the digital euro, including data protection and cybersecurity standards that are essential for maintaining user confidence. Public consultations have been conducted, particularly with banks6, to ensure an inclusive approach7.

A major challenge is managing the risk of disintermediation, i.e. the possibility that CBDCs could bypass traditional banks. To address this, the ECB is considering capping individual holdings of digital euros at around €3,0008. This measure aims to preserve the role of banks in financing the economy, while offering a secure and efficient digital alternative. Furthermore, it is worth remembering that it is lending that creates deposits, not the other way around.

For Julien Prat, this measure guarantees a certain balance: “With a deposit limit set at €3,000, the impact will remain minimal.” He states that “banks will retain most of their deposits and therefore their lending capacity. The risk for them will therefore be contained.”

Jézabel Couppey-Soubeyran, on the other hand, considers this approach restrictive: “This is unfortunate, because a digital euro without limits could re-establish the role of money as a genuine public service. As for the stability of bank deposits, it is important for liquidity, but it is wrong to assume that a decline in deposits will lead to a decline in lending. In fact, it is lending that creates deposits, not the other way around.”

Transaction security is a key priority. The digital euro promises faster and cheaper payments, particularly for cross-border transactions. To ensure the integrity and confidentiality of payments, the ECB is exploring and considering the adoption of advanced technologies, such as cryptography9.

While this electronic currency appears to be a strategic tool for monetary sovereignty, getting the public on board remains a major challenge

Several European countries are conducting experiments and pilot projects to assess the integration of CBDCs into their existing financial infrastructures. These initiatives are helping to identify technical and operational challenges, while gathering valuable data to refine the digital euro model.

In France, the Banque de France is assessing the use of this form of digital currency in specific market scenarios. Tests on the settlement of tokenised securities are exploring the applications of this innovation to modernise financial infrastructures10. At the same time, collaborations with the private sector are examining the feasibility of blockchain for interbank settlements, anticipating changes in the sector11.

In Sweden, the Riksbank, through the e‑krona project, is studying the integration of a CBDC into the national payment system. Tests are evaluating its coexistence with current systems and its ability to meet user needs in a digitalised environment12.

At the European level, the ECB is testing the use of this form of currency to settle transactions on tokenised assets. The aim is to improve interoperability between TARGET services and DLT platforms, facilitating the integration of financial markets and cross-border trade13.

A potential lever for monetary sovereignty

The introduction of a digital euro for the general public (retail) is part of a strategy to reduce Europe’s dependence on payment infrastructures dominated by foreign players such as Visa and Mastercard. Philip Lane, Chief Economist at the ECB, has emphasised that this dependence could limit Europe’s room for manoeuvre in the event of geopolitical tensions, making a domestic alternative necessary14.

Given this reality, the digital euro could theoretically act as a bulwark against the influence of non-European payment systems. By offering a public means of payment accessible to all, it would strengthen the resilience of the European financial system by reducing dependence on foreign infrastructure. At the same time, the emergence of new initiatives, such as the digital dollar backed by the Federal Reserve or stablecoins issued by digital giants, is heightening the need for Europe to assert its monetary autonomy. The ECB sees these developments as a potential threat to the economic stability of the eurozone15. However, Jézabel Couppey-Soubeyran tempers this view: “The digital euro, as it is currently envisaged, will not directly strengthen the international role of the euro, as it is intended for eurozone citizens and banks for euro payments within the eurozone.” In her view, “in order to increase the euro’s international influence, Europe should instead make progress on fiscal union, which would lead to the emergence of a Eurobond that would be in demand from European and international investors.”

Nevertheless, while this electronic currency appears to be a strategic tool for monetary sovereignty, getting the public on board remains a major challenge. A survey conducted by the ECB in 2024 revealed that the majority of European citizens do not see the point of using it for their everyday transactions16. Julien Prat raises a key question in this regard: “Is there a real demand for a digital euro?” After all, “current payment methods work well, and consumers are not expressing any urgent need for this new tool.”