Three threats to digital currencies

- The digital euro would be a currency of the European Central Bank (ECB) in the same way as the Euro is. Unlike crypto-currencies, there would not less risk.

- But the digitisation of currencies has major drawbacks such as the disruption of the dominant currency or threats to data privacy.

- Included in these threats are private-public competition, which is much more complex than elsewhere, and the birth of the metaverse or the web3 making the use of cryptos concrete.

- A last question remains around the trust of users towards these currencies. Would the trust between a digital and a monetary Euro be the same?

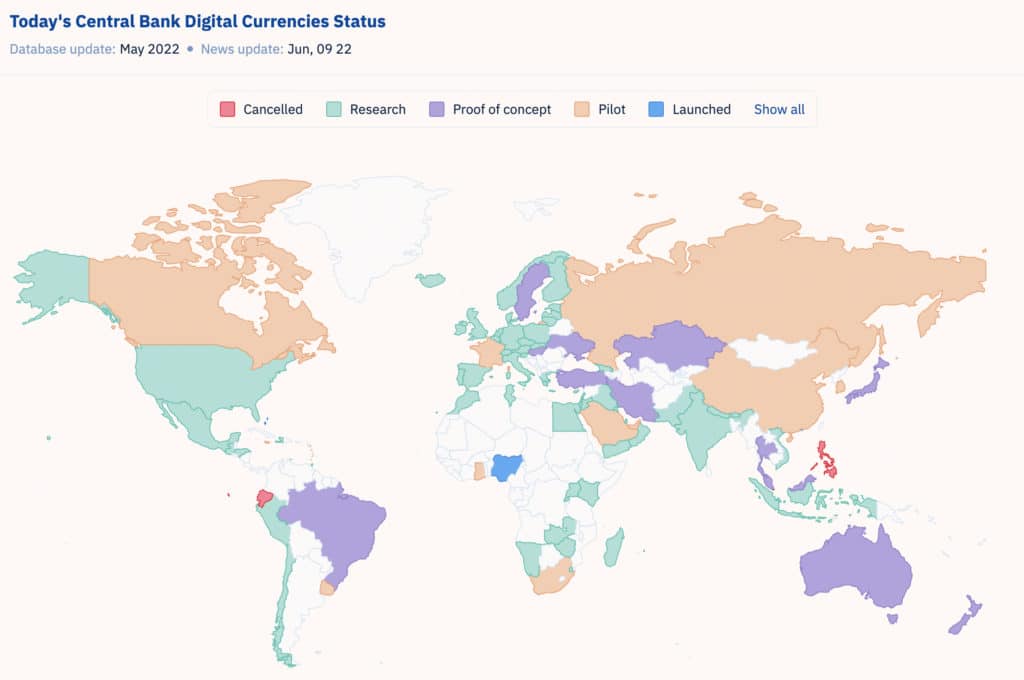

National currencies are not spared from the wrath of the digital transformation. After Lithuania and then China, which recently introduced the e‑yuan, a digital version of its currency, Nigeria has launched its own called the eNaira. Around the world, many central banks, including the European Central Bank (ECB), are looking at similar projects and testing what is now known as a CBDM, a Central Bank Digital Currency.

Such currencies are seen as a digital version of the country’s currency. Thus, the digital euro would be a claim on the ECB identical to the cashless or fiduciary euro. In practical terms, there would be no risk of default for the holder, unlike crypto-currencies such as Bitcoin or Ethereum, which can experience high volatility and are not backed by an existing currency. But there are many parameters that complicate the issue of moving to a CBDM at the same time as threats to the monetary system are growing and worrying central bankers.

#1 Public-private competition

The main threat is competition from private players, which is intensifying with the emergence of crypto-currencies launched by the digital giants, whether American or Chinese. After ambitions to launch its virtual currency called Libra and then Diem, Facebook finally gave up, but other large private companies continue to study the issue of crypto-currencies. The risk is that, by taking over the means of payment, these companies will acquire full visibility of the payments made and therefore of personal data.

In addition to the threat to data confidentiality, there is also a risk of disrupting national currencies. Especially at a time when cash is gradually disappearing, and payments are increasingly virtual. Another important issue is the global competition between central banks. The main central banks are competing with each other to impose their currencies in international trade, particularly against the dollar.

#2 Web3 and crypto-currencies

Although still in its infancy, web3, a new generation of the Internet which largely exploits blockchain technology, constitutes an additional threat. Indeed, new technologies such as crypto-currencies or blockchain already allow the creation and possession of “native” means of payment: digital assets, bitcoins, NFTs, etc. With web3 and the metaverse, all this is becoming very real! In addition, there are now stablecoins, which are stable crypto-currencies. These accelerate the virtualisation of money, as they reduce the risks associated with the volatility of crypto-currencies. When it exists, the digital euro will move to web3 where it will be backed by the central bank and offers relative stability.

The Future(s) of Money conference, organised in Paris by the “Blockchains & platforms” chair at Institut Polytechnique de Paris, is an opportunity for players in the global ecosystem (researchers, central banks, industrial experts, start-ups, crypto-currency creators, etc.) to consider the future of money – or rather “currencies” – at a time of digital transformation, the gradual disappearance of cash, and the proliferation of digital currencies. Will the emergence of a new technology give rise to a new economy? The questions are numerous, the opinions divided, and the topic remains controversial between players in the world of banking, academic research, the private sector or the blockchain. This is a good opportunity to exchange ideas in a constructive way and to see how we can take advantage of the technology.

#3 User acceptance

In addition to these multiple threats and questions, there is the question of whether a digital currency issued by a central bank could meet the demand and expectations of users. Individuals currently use virtual means of payment (bank cards, transfers, payments by telephone or interbank systems, etc.) and many of them do not necessarily see what benefits a digital currency could add.

However, there are a number of advantages to CBDCs. While not answering the question of user adoption, the creation of a digital euro would encourage a relative standardisation of means of payment at an international level. If the digital euro were to become a standard, it would be interoperable, allowing for faster – almost instantaneous – and cheaper payments and exchanges. In other words, international payment systems would be more efficient and reliable.

Opinions remain divided on the contribution of digital technology to the world of money. Some believe that what is happening now is a marginal phenomenon and that it will remain that way; others believe that the developments underway are the backbone of future financial systems; and more others hope that digitalisation will lead to the improvement of current payment systems and to the modernisation of inter-bank and retail payments. The only certainty at this stage is that, whatever option is chosen, the technology will have to comply with the law.