Why are rare-earths metals not like other metals?

Mathieu Xemard. Rare-earth metals are a family of 17 metallic elements with similar physicochemical properties. They are rare only in name since they are relatively widespread on the planet. For example, the most abundant (cerium) is more common in the Earth’s crust than copper. On the other hand, they are highly diluted in deposits where they are not the main metal, and large quantities of ore must be mined to meet demand.

One of the characteristics of these metals is their highly specific trade balance. Separation processes require the isolation of each rare earth from ores where they are all systematically mixed together. The production of each rare earth is therefore not dictated by its own market, but by demand for the most sought-after ones. This is why the more abundant rare earths are struggling to find a market, while others are in high demand. Added to this is China’s near-exclusive monopoly, despite the fact that the world needs more and more of certain rare earths.

What are rare earths used for?

The most abundant (cerium and lanthanum) are mainly used in catalysts for catalytic converters or for the catalytic cracking of oil into petrol1. The gradual disappearance of internal combustion vehicles in favour of electric vehicles can explain why the market is decreasing. Voltage rare earths are those used to manufacture magnets: neodymium, dysprosium, terbium and praseodymium. Their market is booming. Neodymium-iron-boron magnets are the most powerful magnets manufactured today and are widely used to manufacture powerful miniaturised motors, in electric cars in particular. Because of their remarkable magnetic properties, these magnets are also used in offshore wind turbines – from 80 kg/MW to 200 kg/MW of rare earths in 2015, depending on the technology used2 – and in robotics.

You work at the Centre Interdisciplinaire d’Études pour la Défense et la Sécurité. What are the military uses of rare-earth metals?

Once again, they are used in the form of magnetic alloys in motors of all sizes or in hard disks. Because of their optical and electronic properties, they are also used in many optronic applications (observation, guidance, communication, etc.). They are present almost everywhere in weapons systems: for example, an American F35 fighter plane contains more than 400 kg of various materials containing at least one rare earth3. Even if the quantities involved in armaments remain small compared with civilian markets, this raises real questions of sovereignty because of China’s monopoly.

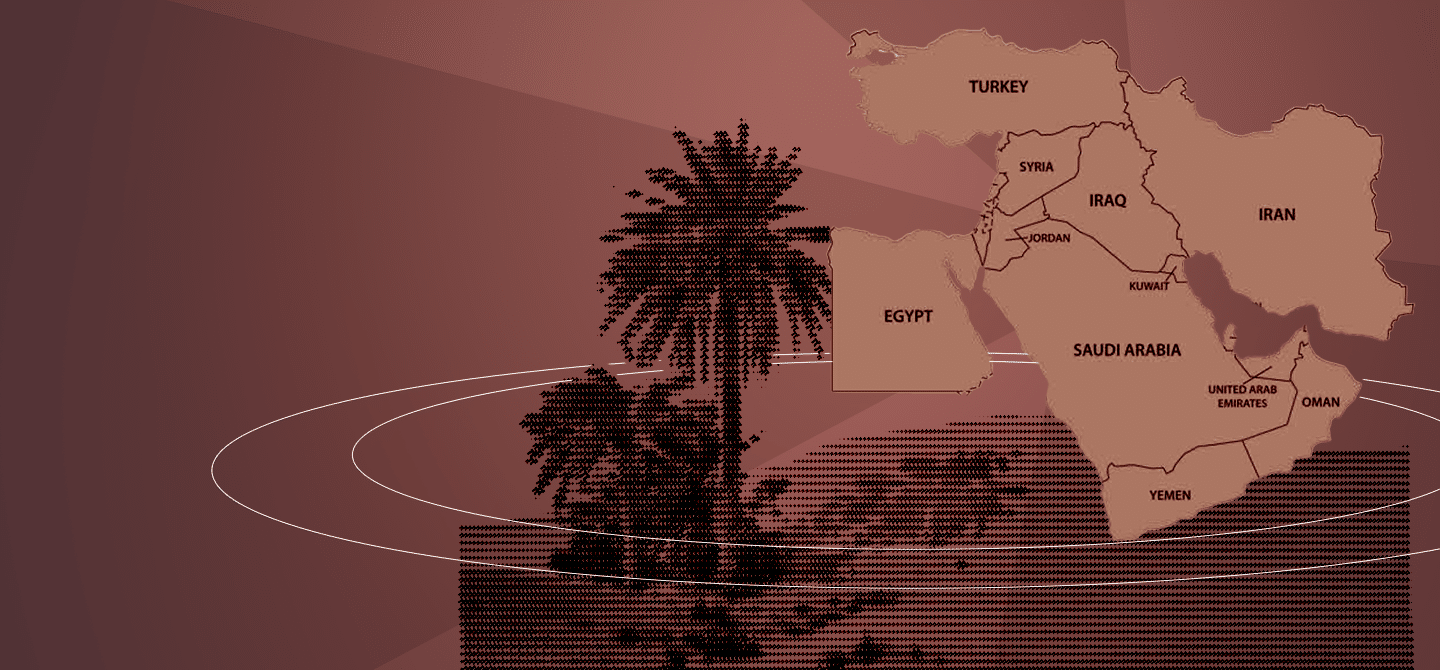

To what extent does China have a monopoly on rare earths?

China accounted for around 69% of the world’s production of rare earth ores in 20234. Far behind are the United States (12%), Burma (11%) and Australia (5%). Once these ores have been extracted, they need to be processed to separate, purify and refine each of the rare earths. However, China is the only country that carries out all these stages, with Australia and the United States selling some of their semi-processed ores back to China to complete the refining! China thus produces 85% of the purified light rare earths used worldwide, and 100% of the heavy rare earths.

Does China have a monopoly on the entire rare earths value chain?

Yes, today China dominates the entire value chain. The country has progressively moved from extraction to separation, via refining and metallurgy, to the manufacture of magnets. In the 1990s, Japan and the United States were the main magnet manufacturers. Their know-how was based on strong expertise in metallurgy and precise control of the composition of the magnetic alloys they produced. But in the United States, Magnequench – the General Motors subsidiary responsible for magnet production – was bought out by two Chinese groups in 1997. In Japan, China first established itself as a supplier of purified rare earths, then pushed Japanese companies to relocate part of their magnet production to gain access to Chinese markets, thereby gaining access to the last missing technologies in the early 2010s5.

China now hardly ever sells raw materials: it uses them to manufacture products with higher added value, such as magnets and electric motors. In 2019, China accounted for 92% of the world’s production of rare earth permanent magnets6. And the country is now establishing itself as a manufacturer of electric cars – the final stage in this value chain – by penetrating the European market.

Aren’t other countries trying to regain a foothold in this market?

A few decades ago, France was a major player in separation, thanks to Rhône-Poulenc (now Solvay). In 1992, for economic and regulatory reasons, its plant at La Rochelle had to restrict itself to certain very specific uses for rare earths. However, at the end of 2022, Solvay announced its intention to relaunch its activities in the separation and purification of rare earth oxides for magnets7.

The main difficulty remains China’s position: if necessary, it can artificially increase price volatility. The economic viability of this type of industrial project is difficult to ensure, and it is now virtually impossible to find private players prepared to make the heavy investments required to open new plants. The United States has decided to get round this problem by placing large orders through the Department of Energy and the Department of Defense to build up strategic stocks. This has already made it possible to relaunch the historic Mountain Pass mine in California and to finance the future opening of a separation plant8.

Are there other ways of curbing the Chinese monopoly?

The first thing to do – and the most effective and quickest – is to reduce consumption. The less we consume, the more we reduce our dependence. One possible approach is eco-design: it is possible to dispense with magnets and rare earths for certain applications, while accepting the associated loss of performance. Secondly, we need to develop companies at every stage of the value chain. This creates competition and helps to break a monopoly situation. If China moves far enough down the value chain, the markets will be less controlled by that state, which is the purpose of the European Union’s Critical Raw Material Act, adopted in 2024.

Doesn’t recycling offer an alternative means of supply?

Yes, of course, as Japan chose to do, for example, following the export quotas imposed by China in 2010. However, recycling remains a costly activity both in terms of energy and economics if we are aiming for rare earth purity levels similar to those obtained from mines.

At Ecole Polytechnique (IP Paris), we are working on the development of products that use recycled materials without necessarily involving the high levels of purity needed to manufacture magnets. For example, we are studying the influence of substitutions or impurities on the magnetic properties of rare earth alloys9. It is also possible to find higher value-added outlets for rare earths whose markets are shrinking (cerium and lanthanum in particular), which would make it possible to increase the added value of rare earth separation activities. The use of artificial intelligence is also envisaged as an accelerator for this type of application. However, this work is not yet at the industrial stage.