ETS2 : fact-check of the new EU carbon market

- ETS2, scheduled for 2028, is a new carbon quota market applied to the transport, construction and small industry sectors.

- By 2030, this market aims to reduce CO2 emissions by around 42% compared to 2005 levels, an average annual reduction of around 5%, equivalent to 63 million tonnes of CO2.

- The aim of ETS2 is to encourage behavioural change by making the switch to electric vehicles more attractive or by encouraging people to replace gas boilers with heat pumps.

- ETS2 revenues are estimated at between €342 billion and €570 billion for the period 2027-2032, but public acceptance of the scheme is a matter of debate.

- The European Commission itself recognises the risk of social impact if Member States do not take sufficient action.

The European Union plans to extend its carbon trading system to the transport, construction and small industry sectors from 2028, opening up a new European carbon market : ETS21. Designed to strengthen the price signal, i.e. information on the upstream price of carbon, this scheme imposes quotas on fuel suppliers to reduce CO2 emissions by around 42% by 2030 compared to 2005 levels2. This reduction corresponds to an average annual decrease of around 5% per year, or an annual reduction of around 63 million tonnes of CO₂ for these sectors combined3.

However, the resulting cost is passed on to consumers via fuel and heating prices. This impact is likely to affect more than 100 million European households4. Among them, isolated or single-parent households would be more exposed to energy price increases5. Many questions remain, illustrating the sensitivity surrounding the price of carbon and concerns about the social acceptability of the scheme. As a result, several Member States have succeeded in postponing the launch of the market until 2028. Member States are calling for a reliable mechanism capable of containing price volatility, as well as adequate funding for the Social Climate Fund (SCF) to take into account the specific difficulties of each country6.

According to estimates, the likely revenue from ETS2 for the period 2027–2032 is between €342 and €570 billion. A portion of this budget would be redirected to the SCF. The aim is to support vulnerable households and finance the energy transition7. However, to ensure the efficiency of the system and its social acceptability, the key parameters boil down to price signals and the allocation of carbon revenues8.

To decipher the issues surrounding this market, Phuc Vinh Nguyen, head of the Energy Centre at the Jacques Delors Institute and researcher on French and European energy policy, published a detailed study in November 2025 on the governance and social impacts of ETS2, including redistribution and frontloading mechanisms designed to limit the effects on vulnerable households9.

#1 ETS2 will work like the current ETS, meaning that households will have to purchase carbon allowances themselves : FALSE

Phuc Vinh Nguyen. The aim is to establish a carbon market that increases the price signal in the transport, construction and small industry sectors. The scheme will not apply directly to the public, as it will be implemented upstream, but the cost will then likely be passed on to them in full. The idea is to encourage behavioural change through this price signal, for example by making the switch to electric vehicles more attractive in the long term or by encouraging people to replace gas boilers with heat pumps.

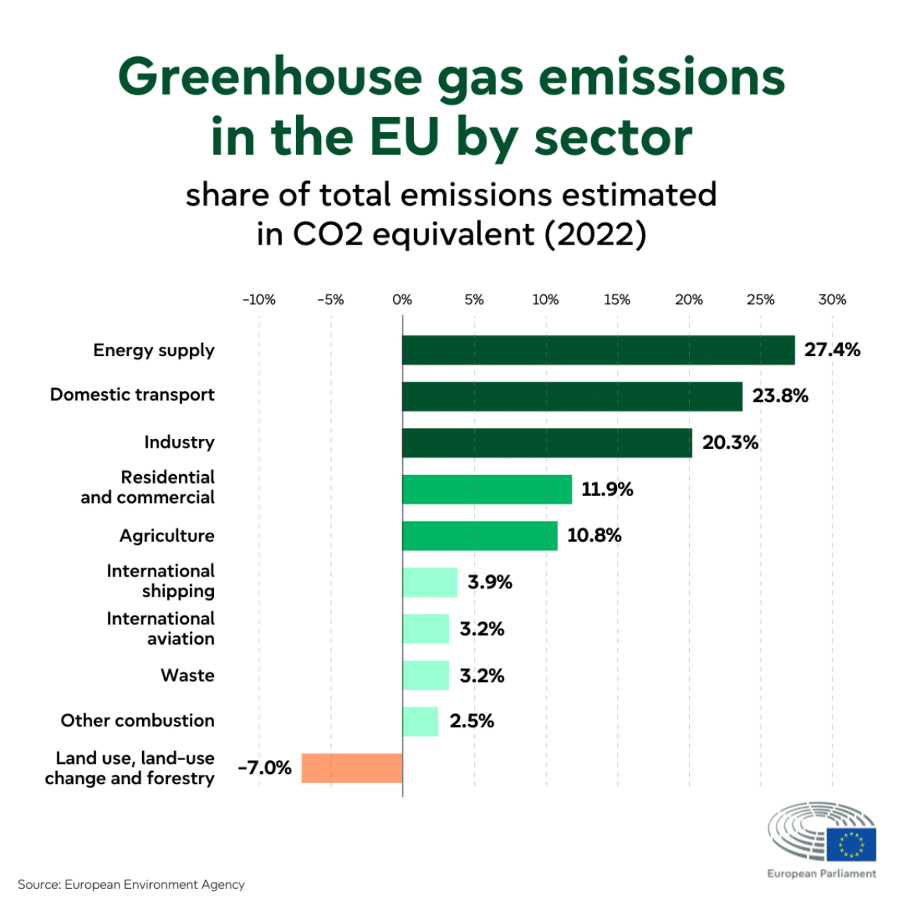

Sectoral breakdown of GHG emissions in France and the EU

Transportation accounts for 32% of national GHG emissions in 202210, 94% of which comes from road transport (mainly private vehicles)11.

Building operations contribute to 15.5% of national emissions in 2022. Residential buildings account for two-thirds, and tertiary buildings for one-third ; heating, hot water and cooking account for most of the emissions12.

Road transport accounts for around 30% of energy-related emissions.

Residential and tertiary buildings account for 12–15% of total emissions13.

#2 The revenue generated by ETS2, estimated at between €342 billion and €570 billion by 2032 according to the European Parliament, will automatically protect vulnerable households : UNCERTAIN

PVN. A significant portion must go towards compensating households with the lowest incomes and those in fuel poverty. Another portion should support investments with high upfront costs, such as electric vehicles or heat pumps, through schemes such as MaPrimeRénov or social leasing. The challenge is to strike a balance so that compensation does not become too dominant, as the mechanism aims to gradually reduce the use of fossil fuels.

Opinion polls show that support for carbon taxes or pricing is fairly low in France, at around 50%. However, it increases when the revenue is clearly earmarked for the energy transition and targets the most vulnerable households. The latest ADEME survey confirms this trend. European research14 also shows that public acceptance depends heavily on the full use of revenues for transition measures aimed at those who bear the brunt of the cost of this transition.

#3 Vulnerable households will not experience increases in heating or fuel prices, as the SCF will compensate for all additional costs related to ETS2 : FALSE

PVN. No institutional source guarantees full compensation. Price increases will depend on the market, supplier choices and national choices, in addition to the effectiveness of the measures put in place. Even with the SCF, there is a risk that some households will still experience significant increases. The Commission itself recognises the risk of negative social impacts if Member States do not take sufficient action. In other countries that have implemented similar carbon pricing schemes, the effectiveness of compensation measures has largely depended on the speed and accuracy of redistribution mechanisms.

A report by Transport & Environment recommends that pre-financing carbon revenues through ETS2 could support the energy transition while mitigating the impact on vulnerable households, provided that comprehensive social support measures are put in place15

#4 Using expected future ETS2 revenues from 2026 onwards would reduce the social impact from the moment the system is launched : TRUE… but with caution

PVN. Several states and NGOs, including Carbon Market Watch, support this option. The idea makes economic sense : invest before price increases reduce households’ vulnerability. This requires mobilising available resources quickly and coordinating aid at a national level to stimulate demand for clean and, ideally, European technologies. The success of this approach will depend on the administrative capacity to deploy this funding effectively and direct it towards the most relevant investments. This strategy does not automatically compensate all vulnerable households, but it can significantly limit the social impact of the first carbon prices.

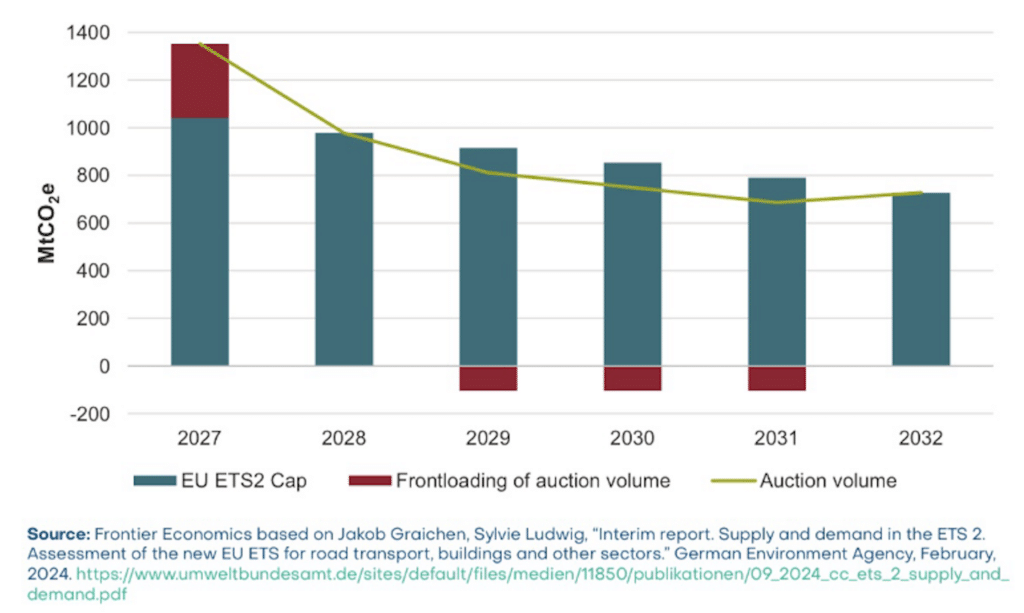

Our recent analyses extend this proposal by broadening its scope. The idea is to use a frontloading mechanism, which involves borrowing now and repaying with future carbon revenues (Figure 2). This mechanism should also be applied to ETS1. It would raise around €200 billion between 2028 and 2034, which could be spent immediately and used exclusively to finance decarbonisation investments, not offsets. This is consistent, since these are investment expenditures, which can have a positive effect on the economy. However, this requires strong communication to clearly explain the link between the carbon price and the investments made possible.

#5 The launch of ETS2 in 2027 is certain, as Member States unanimously support the timetable : FALSE

A postponement to 2028 has already been agreed by Member States and the European Parliament, although it has yet to be formalised. The directive allowed for a postponement until 2028, but not beyond. Going further would require a complete renegotiation, which would be extremely complex. Member States must now create the conditions for implementation of the scheme at a reasonable price. Our recommendation is to set a price floor and a price ceiling, which would guarantee a minimum level of revenue to repay the joint loan and limit excessive price volatility. We also need to consider the very different starting points between Member States, as nine countries already have a national carbon price for these sectors, while others, particularly in Eastern Europe, do not and have lower living standards.

ETS2 was discussed in the context of setting the 2035 and 2040 targets, and the carry-over was used as a bargaining chip to reach an agreement. Future discussions are likely to focus more on the 2028–2034 European budget. The carry-over potential could then become a bargaining chip again in these debates.

Interview by Aicha Fall

↑

https://www.europarl.europa.eu/pdfs/news/expert/2018/3/story/20180301STO98928/20180301STO98928_fr.pdf↑