Why inflation in the US and the eurozone are not the same

- While current inflation may appear similar in the US and the eurozone, the causes are very different.

- In the US, inflation is measured based on current rent prices and rents attributed to homeowners.

- The total weight of rents in the price index is 38% in the US, compared to 6% in the euro area.

- Strong disinflation has started in the US and will reflect the decline in house prices in the second half of 2023.

- In the euro area, the rise in inflation comes primarily from rapidly rising wages in 2023 and rising corporate profit margins.

Inflation trends are very similar in the US and the euro area. The data shows that it started to rise at the beginning of 2021, peaks at 8.5% in the US and 10.6% in the euro area between March and October 2022, and has been declining steadily and slowly since then.

Nevertheless, there is a clear difference between the US and the euro area in terms of the causes of inflation, the impacts of the different components and the explanation of total inflation. To understand this, we need to distinguish between three components of inflation: energy and food prices; actual rents and rents attributed to homeowners; and inflation excluding energy, food, and rents.

The situation in the US

The rise in energy and food prices slows sharply in the US: from 23% year-on-year in June 2022 to 9% year-on-year in February 2023. In looking at US inflation statistics, it is important to note the role of rising actual and attributed rents for homeowners – known as imputed rent. This is a particularity of the US inflation measure. It includes a component representing the attributed rents that homeowners would pay, which move almost exactly in line with the movement in actual rents.

These fictitious rents, attributed to the owners of dwellings, have a considerable weight, which brings the total weight of rents (effective and imputed) to 38% in the US price index. In the Eurozone price index, only the actual rents paid by tenants of dwellings are taken into account, which leads to a much lower weight of rents – of the order of 6%.

Rents (actual and imputed) in the US are rising quite rapidly (8% today) and continue to accelerate. They are reacting with a delay of a little more than a year to the evolution of US house prices, which reached 20% growth over a year before slowing down considerably. In January 2023, house prices have only increased by 4% per year, and over the last few months, they have even declined.

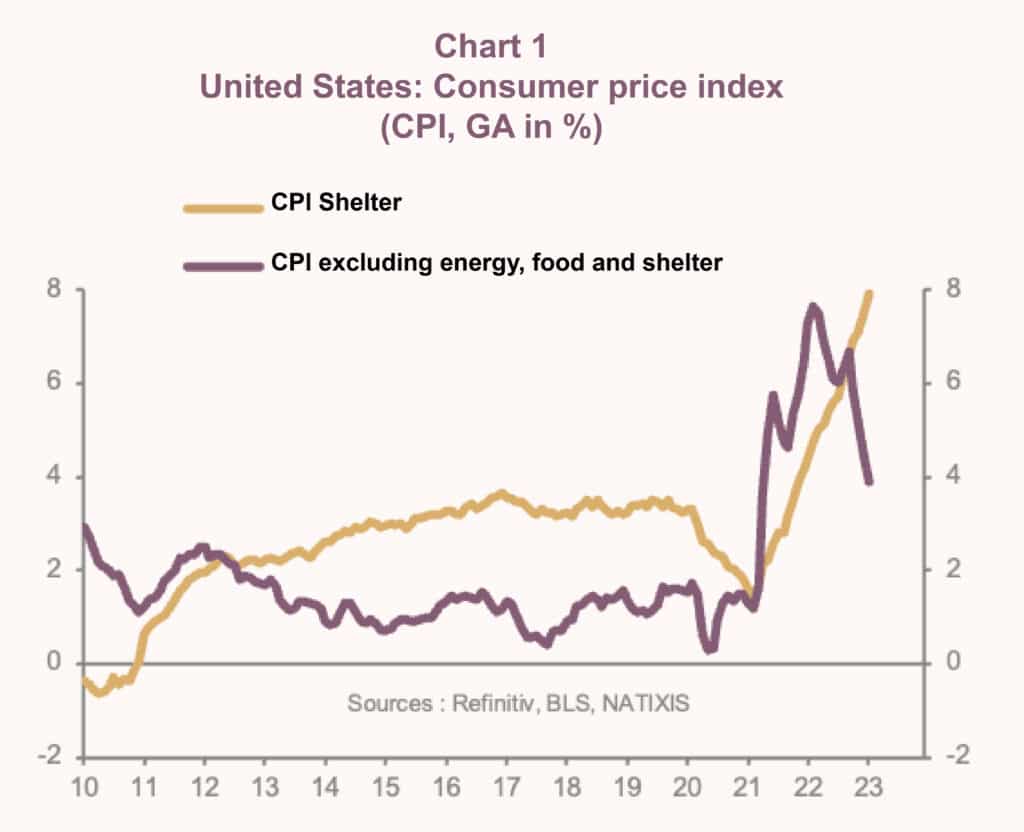

We should therefore expect rents (actual and imputed) in the US to stabilise or even fall if the timeframe is the same as in the past, from the second half of 2023. Finally, the true underlying inflation can be considered as inflation excluding energy and food prices, as well as excluding rents. Moreover, it is this measure of inflation that allows for international comparisons, due to the very different treatment of rents from one country to another.

Strong disinflation has started in the US.

Inflation defined in this way shows a peak in late 2021 and early 2022 at 8% in the US, and declined rapidly since then, to just 3.5% in early 2023. This shows that a strong disinflation has started in the US, which is hidden by rental growth (actual and imputed) that will only reflect the decline in house prices in the second part of 2023 with a long delay.

The situation in the euro area

Energy and food prices slow down sharply (from 32% year-on-year in June 2022 to 18% year-on-year at the beginning of 2023), as all commodity prices (oil, natural gas, agricultural commodities) decline. Effective rents only increase by 2.3% year-on-year in the euro area and therefore do not contribute to the rise in inflation.

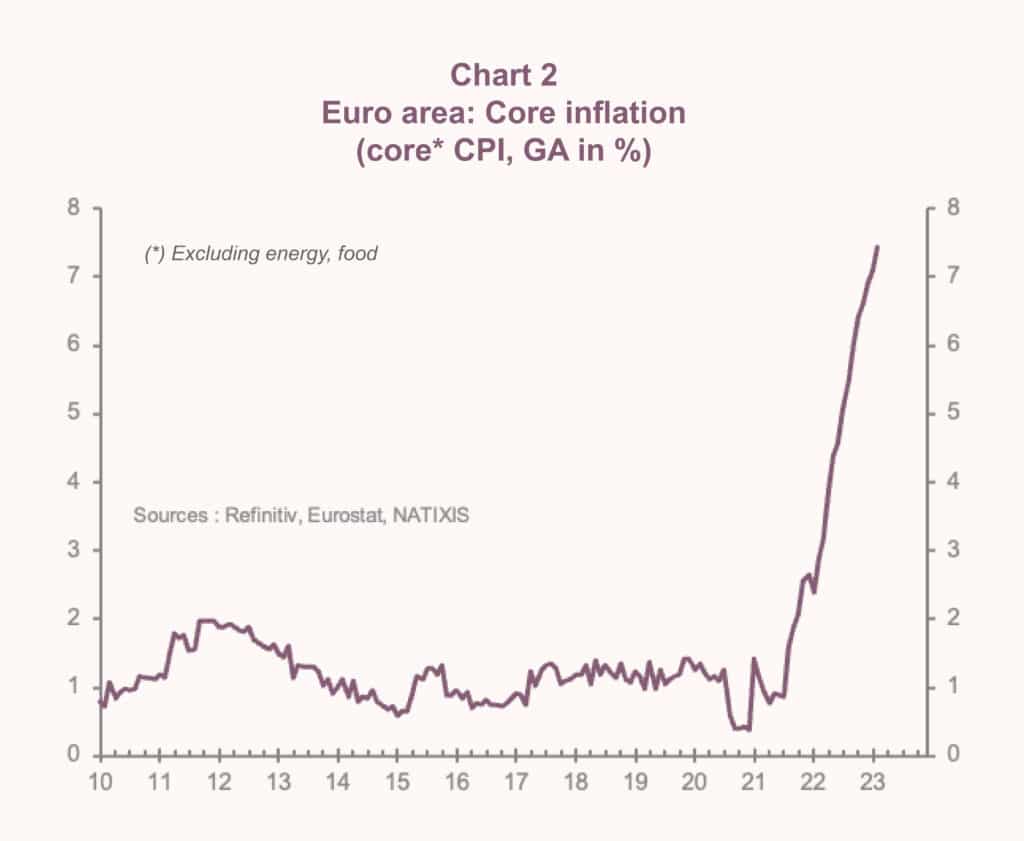

If we use the same definition of core inflation as above (inflation excluding energy and food, and excluding rents), we see a steady rise in inflation defined in this way in the euro area: from less than 1% at the beginning of 2021, to 3% at the beginning of 2022; 6.7% in September 2022, 7.4% in January 2023.

Unlike the US, core inflation, excluding rents, in the eurozone is rising continuously. What is the source of the sharp difference in inflation dynamics between the US and the euro area, when considering inflation excluding energy, food, and rents?

Towards a fall in inflation

In the United States, the fall in inflation since the beginning of 2022 comes from the fact that there is no longer any increase in corporate profit margins and that the growth of wages and unit labour costs is slowing down (from 5% to around 4% per year at the beginning of 2023). This slowdown will become more pronounced at the end of the year, with rents slowing as a result of falling house prices and wages being indexed to 2023 inflation, which is significantly lower than 2022 inflation.

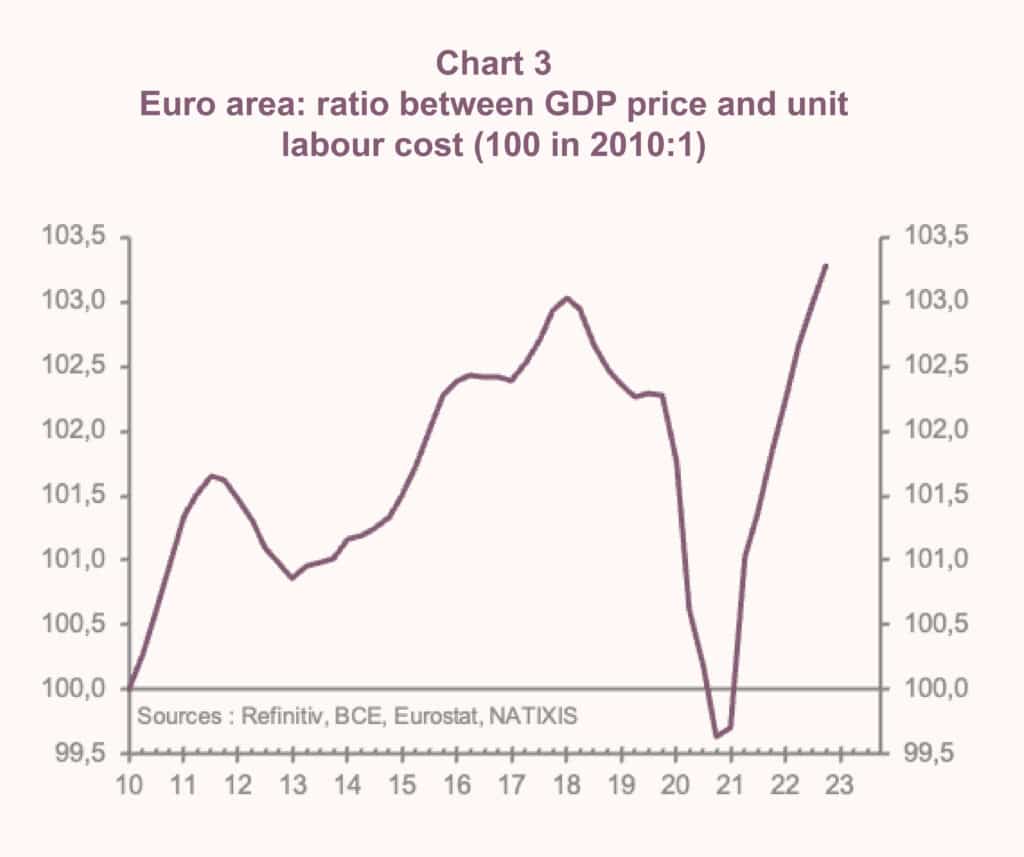

Jerome Powell, Chairman of the US Federal Reserve, has probably won his bet: to show a sharp drop in inflation in 2023, while avoiding a recession. In the eurozone, the rise in inflation (still calculated excluding energy, food and rents) that continues into 2023 comes on the one hand from the faster rise in wages in 2023 than in 2022 with a purchasing power catch-up effect and in the absence of productivity gains; on the other hand from the rise in corporate profit margins that has lasted since late 2020.

It is impressive that companies in the euro area have managed to increase their profit margins at a time when energy and other commodity prices were very high. This increase is responsible for a surge in inflation at the beginning of 2023 of almost 2 percentage points. This surge in inflation (excluding energy, food, and rents) in the euro area suggests that inflation will be very resilient downwards, as it leads to higher wage increases, and that the catching up of profit margins and corporate profits may be far from over.